Reducing Federal Income Tax with the LHPH Model

Jensen Lazar | October 13, 2022

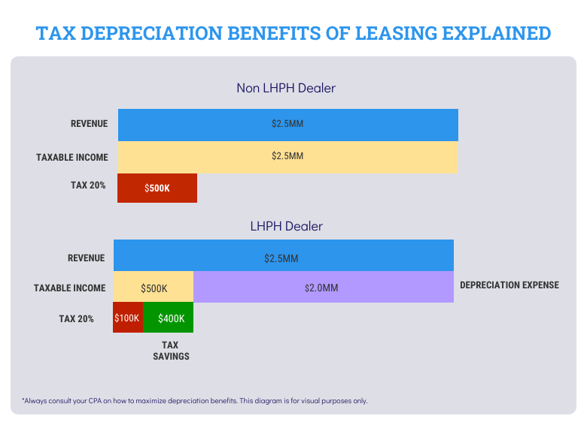

The LHPH model offers dealers the opportunity to mitigate Federal Income Tax payments significantly. As a LHPH dealership, because you own the vehicles (assets), you can write off the depreciation of these assets on your income taxes under Net Operating Loss (NOL). Accounting for Net Operating Loss allows you to reduce income taxes, and this has become even more advantageous since the passing of the 2018 Tax Cut and Jobs Act.

The 2018 Tax Cut and Jobs Act allows you to use bonus depreciation standards when depreciating vehicles. This means that LHPH dealerships are able to utilize 100% bonus depreciation for the first twelve months of a lease. Under current law, bonus depreciation can be able to be applied to all leases originating between now and 2023 and then will decrease in increments of 20% each year afterwards.

Here’s an example: Imagine you lease 15 cars per month for one year with an average Actual Cash Value (ACV) of $10,000. Using bonus depreciation, you can depreciate 100% of the 180 vehicles in your portfolio, resulting in a total tax dedication of $1.8 million.

If you prefer to use straight-line depreciation, the LHPH model still provides you the opportunity to significantly reduce your income tax payments.

For example, imagine you have 300 accounts in your portfolio with an average ACV of $10,000 per vehicle. If you use a five-year depreciation rate down to zero (20% per year), you have $3 million in assets in your portfolio and you will be able to claim up to $600,000 in depreciation to offset your net income.

Whether you choose to take advantage of the bonus depreciation approach or use straight-line depreciation, the ability to account for the depreciation of your vehicles on your Federal Income Tax forms provides a great opportunity to reduce business expenses.

Check out our Youtube page to learn more about the tax advantages of leasing!